Keep on top of your portfolio developments with myPrivatam

Published on April 5th, 2022

On Monday, April 4th, it was announced that Tesla’s founder Elon Musk had amassed a 9.2% equity stake in Twitter.

The result ➡️ shares of Twitter going up as much as 27% intraday.

Do you need to be scanning news such as the one above to keep on top of your portfolio developments? Of course not, the platform myPrivatam does it all for you!

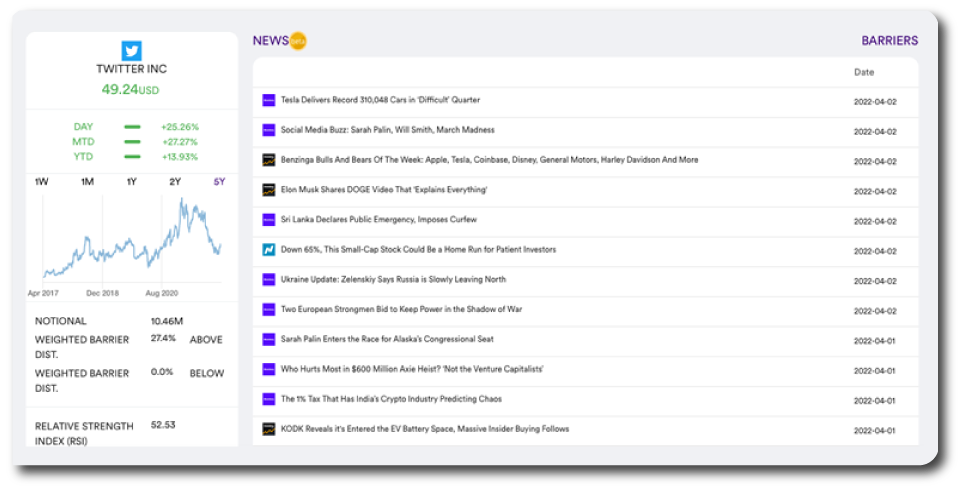

As we arrived yesterday morning, we were immediately alerted about Twitter’s price movement on our customized news feed. Upon clicking on Twitter, we can immediately be brought up to date on what’s going on by reading the news related to the stock.

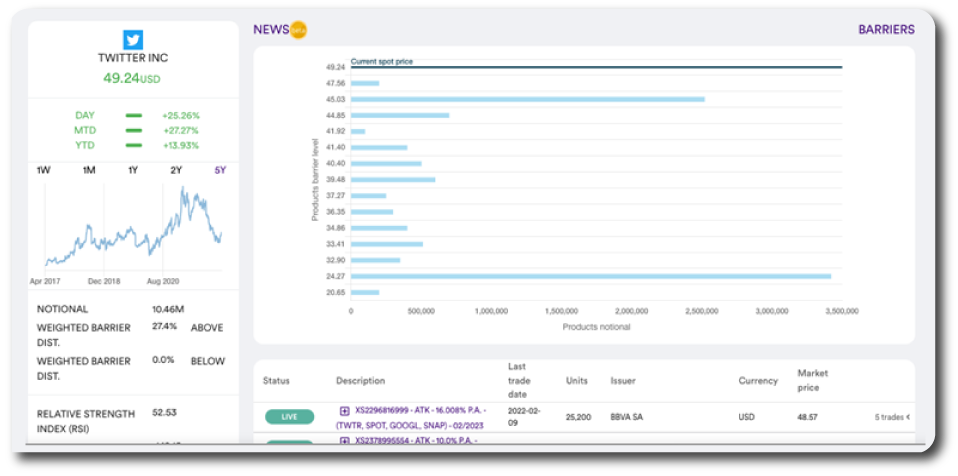

Next thing to do is to get an overview on the Twitter exposure across our portfolio. We access a chart which plots all the barrier levels of our Twitter-linked notes relative to Twitter’s current price.

Good news: with the latest price action, all our products are within the protection range. Thanks, Elon!

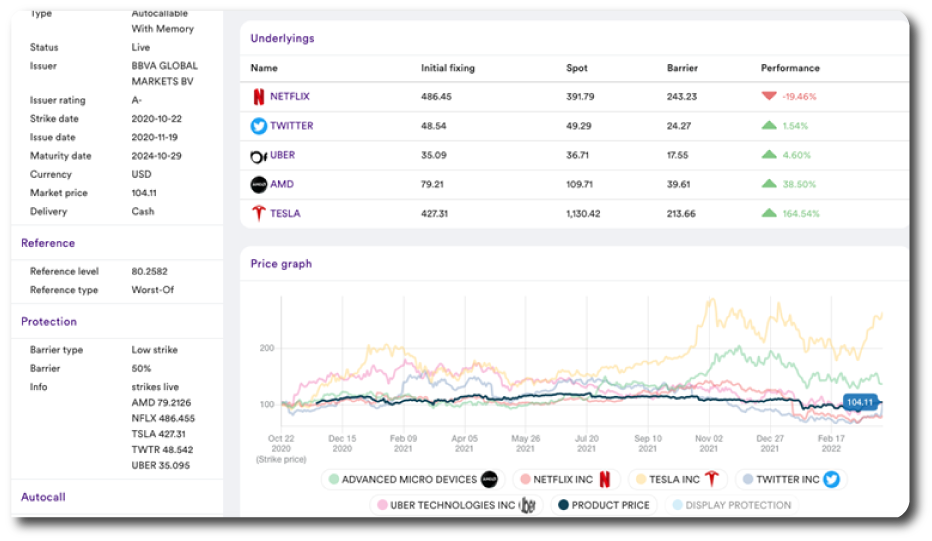

Still, we click on one of our Twitter-linked notes to see if it merits any action.

With today’s gain, Twitter is comfortably above its strike. We are however reminded that another share – Netflix – is down almost 20% from its initial fixing.

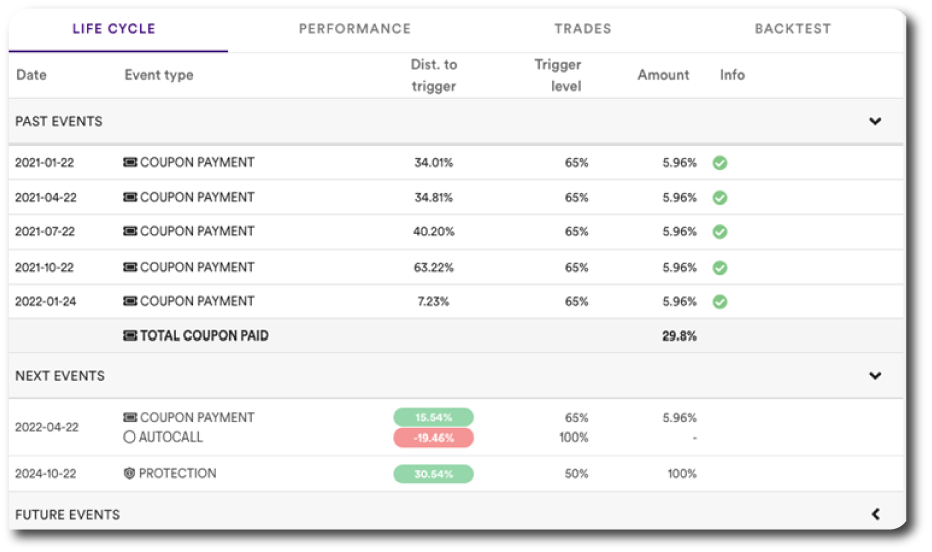

Yet, the product is worth 104% and has paid to date 29.8% worth of coupons.

Should we sell and bank the profit?

Always keep on top of your portfolio developments with the Privatam platform.